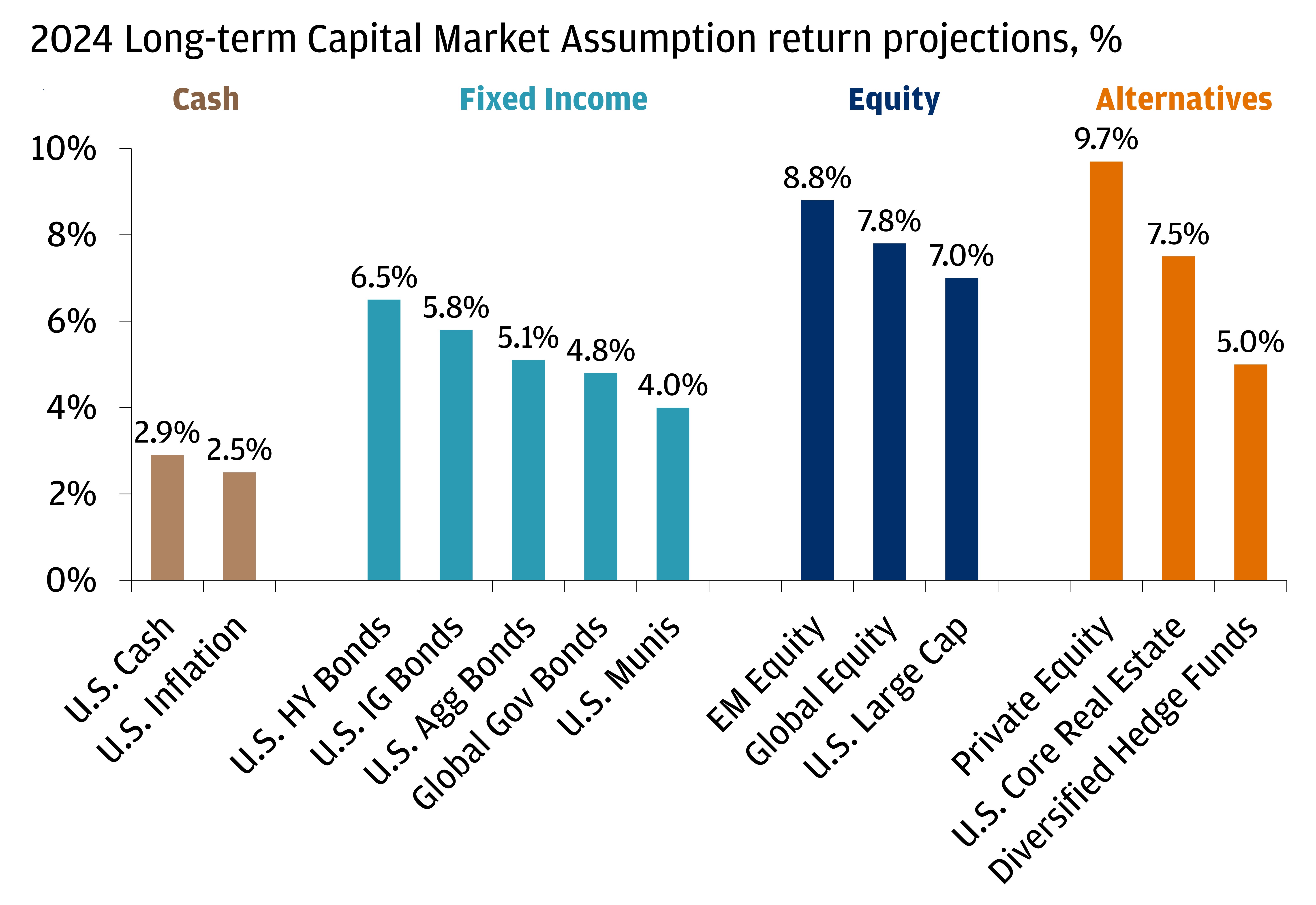

Jpm Capital Market Assumptions 2024. The market expectation is at 2.4%. December 6, 2023 3:22 pm.

We also include a section on estimating expected returns and. As money is no longer free, markets will reward a more selective approach to asset purchases.

The Average From 2010 To 2019 Was 1.5%.

Data as of 29 december 2023.

Blackrock Investment Institute, February 2024.

This chart shows the j.p.

The 2022 Peak Was 7.9%.

Images References :

Source: www.bnymellonwealth.com

Source: www.bnymellonwealth.com

2023 Capital Market Assumptions BNY Mellon Wealth Management, As money is no longer free, markets will reward a more selective approach to asset purchases. We also include a section on estimating expected returns and.

Source: am.jpmorgan.com

Source: am.jpmorgan.com

2024 LongTerm Capital Market Assumptions J.P. Asset Management, Blackrock investment institute, february 2024. In today’s note, we summarize some of the top questions across categories and address the key concerns that clients have expressed.

Source: www.northerntrust.com

Source: www.northerntrust.com

ASuite by Northern Trust, In today’s note, we summarize some of the top questions across categories and address the key concerns that clients have expressed. Currently, this is at 3.3%.

Source: global.pimco.com

Source: global.pimco.com

PIMCO’s Capital Market Assumptions, February 2022 PIMCO, We also include a section on estimating expected returns and. Dollar 2024 estimates and correlations | u.

Source: www.pgim.com

Source: www.pgim.com

Q2 2023 Capital Market Assumptions, From the end of november (just before we published our outlook) to now, a global benchmark 60/40 allocation has outperformed cash by more than 6%. Dollar 2024 estimates and correlations | u.

Source: am.jpmorgan.com

Source: am.jpmorgan.com

LongTerm Capital Market Assumptions J.P. Asset Management, Currently, this is at 3.3%. From the end of november (just before we published our outlook) to now, a global benchmark 60/40 allocation has outperformed cash by more than 6%.

Source: www.invesco.com

Source: www.invesco.com

Quarterly LongTerm Capital Market Assumptions, From the end of november (just before we published our outlook) to now, a global benchmark 60/40 allocation has outperformed cash by more than 6%. This chart shows the j.p.

Source: privatebank.jpmorgan.com

Source: privatebank.jpmorgan.com

Giving thanks 5 things we (and markets) are grateful for J.P., The market expectation is at 2.4%. From the end of november (just before we published our outlook) to now, a global benchmark 60/40 allocation has outperformed cash by more than 6%.

Source: issuu.com

Source: issuu.com

Longterm Capital Market Return Assumptions by Q.M.S Advisors Issuu, Currently, this is at 3.3%. Dollar 2024 estimates and correlations | u.

Source: www.nb.com

Source: www.nb.com

Capital Market Assumptions 2024 Implications for European Insurance, This chart shows the j.p. Dollar 2024 estimates and correlations | u.

In Today’s Note, We Summarize Some Of The Top Questions Across Categories And Address The Key Concerns That Clients Have Expressed.

Morgan asset management long term capital market.

Currently, This Is At 3.3%.

This chart shows the j.p.